Tax system in Monaco

Taxation

The main characteristic of the Monegasque taxation is the total absence of any

direct taxation. The absence of any income tax is the result of an order issued

in 1869 by Prince Charles III.

The only direct tax levied in the Principality is the tax on the profits of

industrial and commercial activities. There is no wealth tax, property tax or housing

tax in the Principality.

Taxation of individuals

Monegasques and residents of the Principality, with the exception of French

nationals governed by the 1963 Franco-Monegasque bilateral agreement, are not

subject to income tax. However, the absence of personal income tax only

concerns activities or persons actually and truly established on the territory

of the Principality. This fact does not affect the rules set by the other

States.

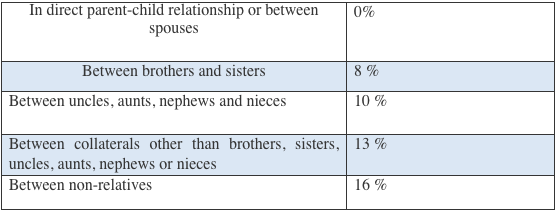

Inheritance and gift taxes (see below) apply to assets located in the

Principality or based there, regardless of the domicile, residence or

nationality of the deceased or donor (subject to the provisions of the

Franco-Monegasque convention of April 1, 1950).

Business taxation

Tax on profits (ISB) :

Companies which carry out an industrial or commercial activity and which

generate more than 25% of their turnover outside Monaco are liable to ISB. Only

the nature of the activity and the location of the company's operations

determine the tax liability, the legal form has no influence on the taxation of

a company.

The taxed profit is established after all expenses, including the remuneration

of the operator, directors, or executives. The tax rate is 25% since January 1,

2022, it being understood that capital gains arising from the sale of fixed

assets during the course of business may, under certain conditions, be exempted

from taxation provided they are reused.

Companies created in the Principality, which are subject to income tax and

develop a genuinely new activity, are exempt from this tax for the first two

years and benefit from a preferential regime for the following three years.

In addition, it should be noted that administrative offices are subject to

B.S.I. and, as a general rule, are taxed at a reduced rate on a flat-rate basis

corresponding to the funds required for their operation.

VAT :

VAT :

Value added tax (VAT) is levied on the same basis and at the same rates as in

France; the intra-Community VAT system has been applicable since January 1,

1993.

Taxation of real estate in Monaco

In Monaco, there is no taxation on real estate capital gains, no housing tax

and no property tax.

Nevertheless, it is necessary to pay registration fees which may be fixed

(generally 10 euros) or proportional.

The most commonly used rates in real estate are :

- he 1% duty applicable to leases, levied on the amount of the annual rent, plus charges

- The 2% duty applicable to judgments

- 3% duty applicable to deeds carrying a mortgage obligation for the benefit of the lump sum

- 5% duty on sales of movable property, reduced to 2% for certain sales by public auction

- 6.5% duty on sales of real estate

- 7.5% duty on transfers of property for valuable consideration of business or clientele

- Transcription duty of 1% on transfers of real estate

- Mortgage registration duty of 0.65

VAT is also automatically applied to sales of building land and buildings within five years of their completion by taxable persons acting as such. The tax is 20% and is payable by the seller.